By Krish Saraf

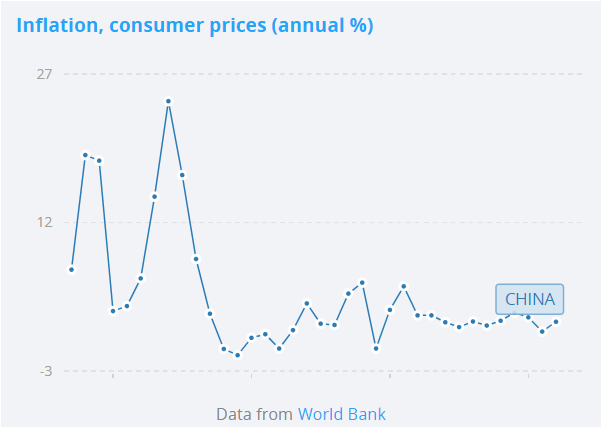

If you haven’t noticed, many countries are experiencing inflation. Inflation is a general rise in prices over time. As inflation rises, the purchasing power of money decreases. This means a loss of consumer confidence in the markets which slows down overall economic growth. Well, China is experiencing the opposite of inflation. They are experiencing something called deflation. Deflation, as the term suggests, means a general decrease in prices over a period of time. Deflation occurs when the inflation rate falls below 0%. Though this might be good for the general public, as increasing consumption and better living standards are the general effects of deflation, there are still downsides. Deflation can pave the path for higher interest rates, unemployment, and decreased production. So where does China stand in all of this? Why is China experiencing deflation? Let me rephrase. China is experiencing signs of deflation, as extra pressure is being put on Beijing, the capital of China, to reignite its growth or face the issue of falling into an economic trap that could make it very hard to escape from.

China, as mentioned before, is at risk of a prolonged period of falling prices. If this continues to play out, this would devour corporate profits, weaken consumer spending, and increase the unemployment rates within the country. But let’s break this down. How is the country being impacted? Prices charged by Chinese factories, which produce products such as steel or cement, have been continuing to decrease for months. Common goods such as sugar, eggs, and clothing are seeing price falls on a month-to-month basis on top of weakening demand. But what is most alarming is that many economists are seeing parallels between what China is going through and what Japan has already experienced, as the latter has been struggling for years with deflation and limited growth. In the 90s, the Japanese stock market took a hit and many Japanese companies had to cut back on their spending in order to pay off growing debt. This situation is similar to what China is experiencing today. The usual methods of fighting deflation are quite unpopular in Beijing, or lack depth because of the country’s debt and various issues.

On top of the weakening demand and price falls, things may be looking up in the international markets. As other countries face inflation, the extended deflation in China may be a solution to cooling down price increases. However, this may not last for an extended period of time. A cut on the price of Chinese exports may hurt rivals in other countries which would hurt jobs and investments made in those countries. Since this deflation would weaken demand, this would hurt parts of the world that rely on export earnings. To provide the numbers, the annual consumer inflation rate was 0% and producer prices fell by 5.4% just the year before. As governments began to lift lockdowns, Western demand was eased which turned everything upside down. This was where producer prices began to fall month by month, impacting the economy. As the export markets started to lose hope, many clung to the idea that Chinese consumers would acquire that excess inventory, but that hasn’t been the case. And since there has been more emphasis on domestic markets, the pressure on prices has only been increasing. But as the thought of increasing debt reaches towards Chinese businesses, more of them have been switching to domestic markets as incomes begin to fall and profits are turned into losses. Is there a plausible solution in sight?

The general response to fighting deflation is to increase the monetary flow within the economy. This would require lowering the interest rates and printing vast amounts of money to ignite more spending and borrowing. The idea is to trigger a period of inflation which would theoretically help the economy begin to grow. Many economists believe that China has the ability to avoid a long-lasting period of deflation. The economy has not stopped growing. In fact, it is growing, just not at the exponential rate seen in the early 2000s. Additionally, the government has issued several stimulus measures which would help bolster the economy. But current economic data is continuing to show that many Chinese companies would rather play it safe and not take on new debt to expand their production. Homeowners in China are choosing to pay mortgages earlier than usual. Regardless, these are signs that there is weakening demand for borrowing money, which would hinder the effects of interest rate cuts. Companies and citizens already have debt amounts that need to be taken care of. Adding on more debt increases their risk, which is something they are trying to avoid in this unusual economic period. The common response to all of this, by Chinese citizens, has been to save more money and spend less money. Though it may continue to hurt the economy, consumers have seen this as keeping themselves financially safe. Though there is not a clear solution to the issue, it truly is tough to say where China will be heading and if an extended deflationary period will happen.