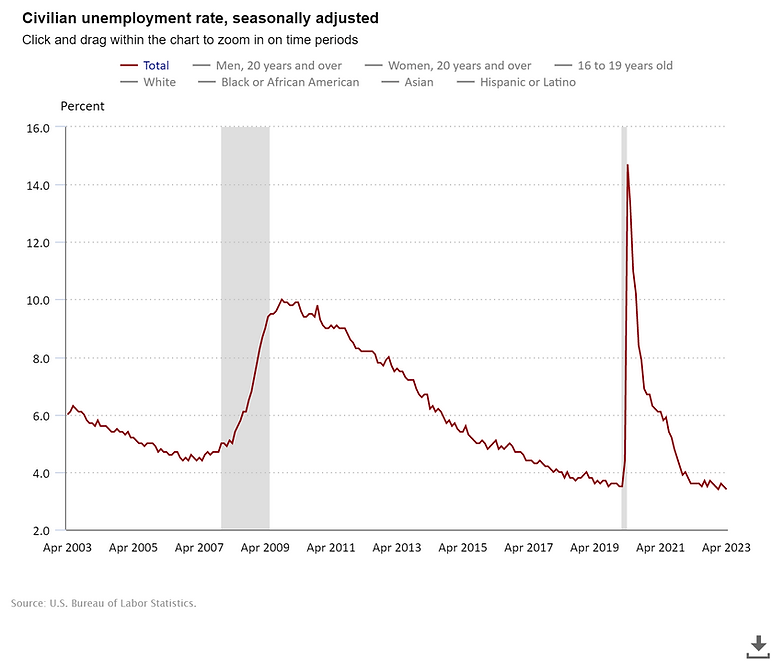

Imagine this: the economy crumbles, millions of jobs are lost, and consumer confidence drops. This sounds horrible, but it could materialize very soon. The economy could collapse if the US does one thing—default on its debt. The US government borrows money in order to pay for federal programs and support the economy. During and in the wake of the COVID-19 pandemic, the government has borrowed more money than usual as policies and programs such as tax cuts and stimulus programs have been implemented. From 2022, US debt rose from $30.93 trillion to $31.46 trillion in 2023. With that, the national debt is approaching the debt ceiling—a limit set on the amount of debt the federal government can owe—and the risk of economic collapse increases.

Perhaps the biggest consequence of a default is entering a recession—a cycle of economic contraction caused by a general drop in overall consumer spending. This is most likely to be caused by a protracted default, a worst-case scenario, in which the federal government would fail to pay its debts by the time they’re due. With this type of default, there is the potential that the stock market could crash by 45 percent. Additionally, 8.3 million jobs could be lost as the resulting shortage in the money supply would prevent companies from paying their workers. As ongoing government spending is increasing, the US could default on its debt as soon as the start of June.

Currently, there is a debate in Congress regarding the options available to prevent a default. There are two main fiscal policies that are up for debate. The first policy, crafted by House Republicans, promotes both spending cuts and borrowing cash. The goal of this policy is to increase the government’s ability to responsibly borrow while allowing the Treasury to pay its bills. Republicans point to the fact that putting a cap on federal spending would eliminate two-thirds of the current deficit in the span of a decade. House Democrats champion a different policy: they say that the debt limit should be increased so that there is more time to pay off the national debt while maintaining the current budget. Proponents point out that raising the debt limit would help keep the economy afloat in the face of present recessionary trends. As well, the current budget implements policies that Democrats have strongly campaigned for, like climate action. This would greatly improve the political situation for House Democrats, who faced minor setbacks in the 2022 midterm election. However, with unpredictable political currents, the outcome of this feud may not be what either the Democrats or Republicans have in mind.

By Krish Saraf