The COVID-19 pandemic had a major impact on the global economy and our daily lives. The year 2020 will forever be remembered in infamy. But before we delve into the ordeals of 2020, it is important to take a look at the economic landscape of the United States prior to the pandemic.

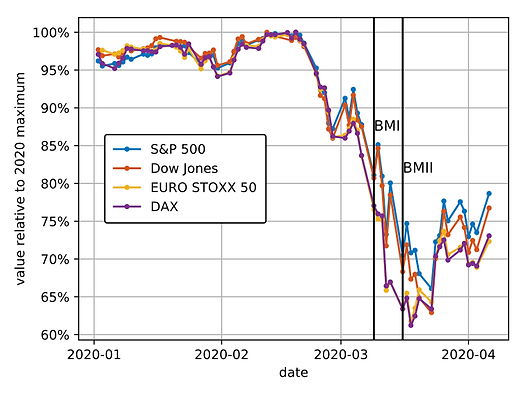

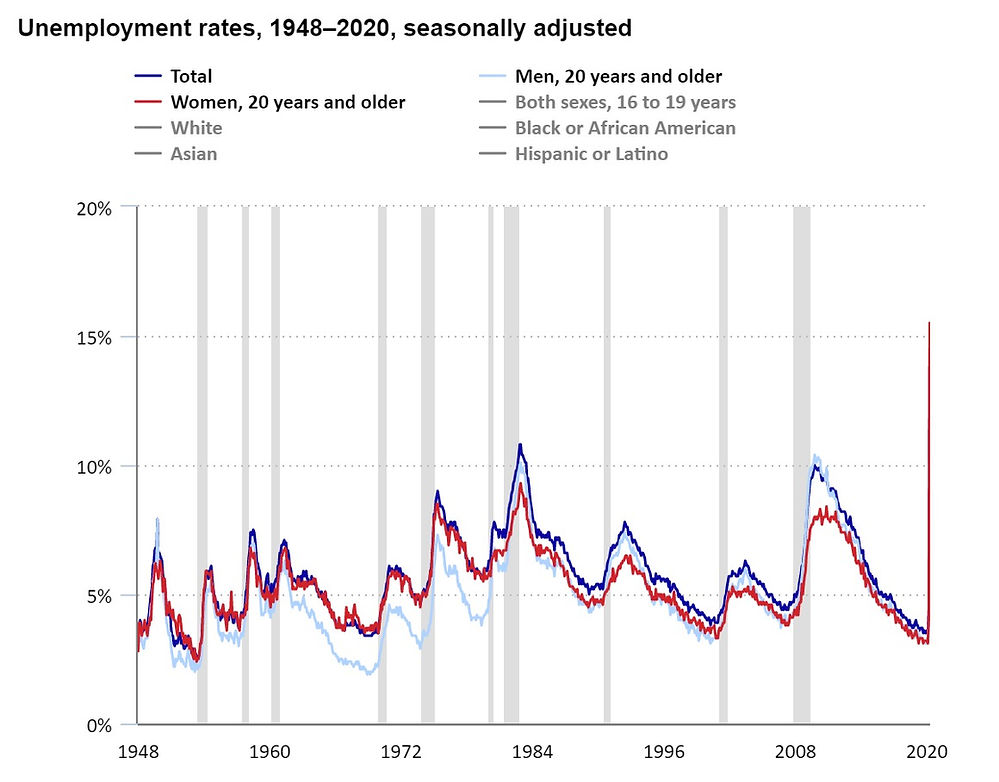

The American economy had been growing steadily since the stock market crash 0f 2008. In 2019, it reached its peak, valued at $21.13 billion with a 5.4 percent increase from the previous year. However, the COVID-19 pandemic changed everything. The virus spread quickly, and concerns about its potential consequences led to a significant downturn in the stock market. The Dow Jones, a stock market index used by many stockbrokers, experienced its largest dip in history—dropping by 10,000 points. To avoid getting sick, people began adopting new lifestyles, staying at home and avoiding public places. This led to the emergence of new industries, such as Zoom and Instacart, which enabled people to work and shop from the safety of their homes. However, the impact on other sectors of the market was devastating. Brick-and-mortar stores saw their sales plummet by over 80%, and many restaurants were forced to close their doors permanently—creating a massive spike in unemployment.

To prevent a similar economic catastrophe from occurring in the future, it is crucial that we focus on building a strong and resilient economy. In a normal economic curve, there are three characteristics that remain constant: the trough, the peak, and LRAS. The trough is the lowest point of the economy, which is considered a recession. This is when the economy hits rock bottom and resources become scarce. The peak is the highest point of the economy, occurring when the economy is overproducing everything. Finally, LRAS is the maximum production and productivity the economy can achieve with the resources provided. When the economy reaches LRAS, it produces all resources efficiently and uses maximum productivity. Our economy must strive to achieve LRAS, as this is the most efficient way to beat inflation and other economic downfalls. If we can achieve this, inflation and recessions will be a thing of the past, and the economy will thrive. However, achieving LRAS is a difficult task. Resources are scarce, and productivity is volatile. Maintaining LRAS for extended periods of time is also challenging.

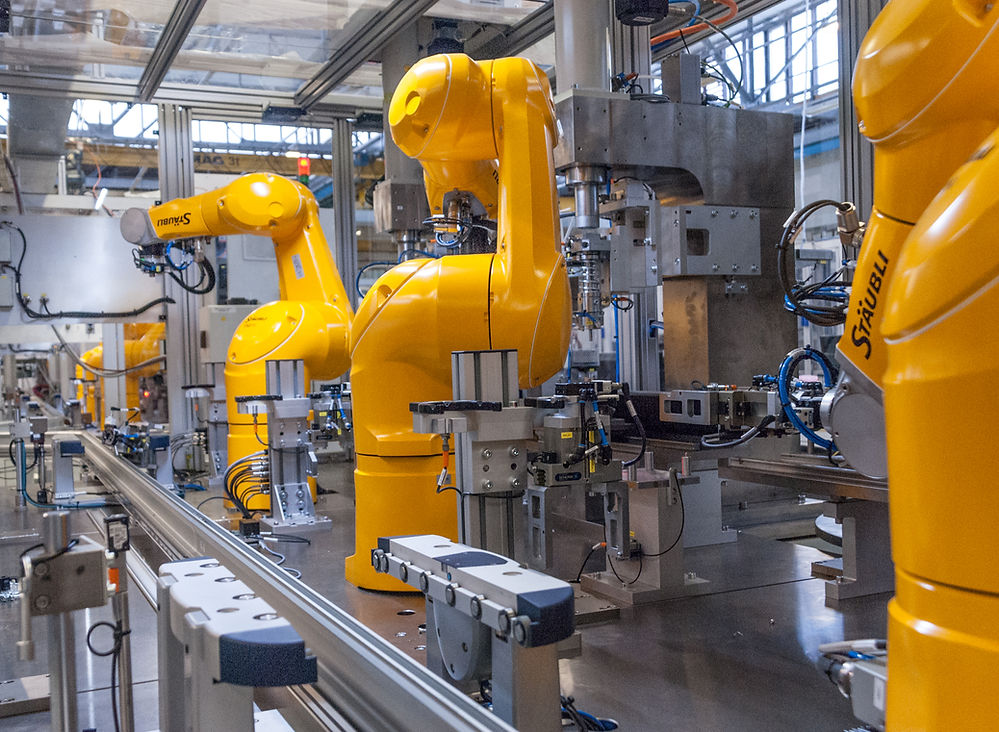

Despite these challenges, technological advancements are occurring at a rapid pace, and resources are being produced from thin air. The development of robots in the workforce is also increasing productivity exponentially. As a result, it may be possible to achieve LRAS in the future. For now, our economy must focus on bouncing back and moving forward one step at a time. The pandemic has shown us the importance of resilience and adaptability in the face of economic challenges. We must continue to invest in new industries and technologies that enable us to thrive during uncertainty.

In conclusion, 2020 was a year of unprecedented economic challenges. However, it also highlighted the importance of building a strong and resilient economy. Achieving LRAS is a difficult but essential goal that we must strive for to prevent future economic catastrophes. The road ahead may be challenging, but by investing in new industries and technologies, we can build an economy that is better equipped to handle the unexpected.

By Shreyes Srinivasin